Many collectors start with a coin value app because it gives structure and prevents early mistakes. It identifies the type, shows official details, and forms a basic value corridor. This helps, but true pricing depends on condition, grade rarity, survival patterns, and market behaviour.

A collector can estimate value with high accuracy by combining two methods: digital tools and careful physical evaluation. Below you can see two ways of how to estimate the coin’s value that work for beginners and experienced hobbyists.

Method 1: Using Apps to Support Valuation

Apps for coin estimations are quite popular today, as they help classify a piece in seconds, provide official data linked to the type, and set a basic price corridor. Apps speed up early research, reduce confusion between similar designs, and make large batches easier to organise.

What Coin Apps Actually Do

Tools built for identification simplify the first stage. A coin identification app recognises the outline, inscriptions, and layout, then matches the coin to a known type. This removes confusion between similar designs and keeps research on the right path.

Apps reveal:

- Denomination and issuing country

- Mint years and design version

- Official diameter, weight, edge type

- Standard metal composition

- Broad value ranges based on typical market behaviour

This helps confirm that the coin fits official parameters. If measurements, metal tone, or layout differ, the collector knows to investigate further.

How Apps Estimate Value

A coin value checker app forms estimates from common sales, reference guides, and typical grade behaviour. It does not analyse your exact coin; instead, it predicts what the type usually sells for under normal conditions. This gives a stable reference point, especially for unfamiliar series or world coins with many similar issues.

But not as simple as we wish. Some things apps cannot do. Even the most advanced tool cannot detect fine wear, cleaning traces, corrosion, or subtle surface differences. It does not evaluate grade distribution or survival patterns. For this reason, apps act as the starting stage only.

For example, the Coin ID Scanner app identifies the type, shows official specs, and stores photos for comparison. It speeds up classification and prevents errors when working with large groups of coins. After this step, the collector performs manual checks to reach the final value.

Method 2: Manual Valuation Step by Step

Manual evaluation remains the most accurate way to determine a coin’s true worth because it focuses on the specific specimen rather than the general behaviour of its type. Digital tools classify and outline the basics, but only direct inspection reveals condition, subtle design traits, surface history, and real market alignment.

The method below gives a structured, sequential workflow. Each step builds on the previous one, helping collectors form a reliable value without a professional appraisal.

Step 1: Confirm Type and Variety Manually

Once the app identifies the coin, manual inspection verifies elements that influence rarity and price. Many series include small variations that look identical in photos but differ in value. Checking these traits ensures the coin is correctly attributed.

| Element to Check | Why It Matters |

| Mint mark shape and position | Varieties and relocated marks create premium tiers |

| Portrait version | Minor design shifts reveal specific issues |

| Lettering style | Serif changes, spacing, and punch differences signal varieties |

| Reverse variations | Small elements—leaves, digits, stars—affect rarity |

| Production differences | Early vs. late strikes behave differently in the market |

Even one overlooked trait can shift the coin from a common piece to a scarce variety with a higher price.

Step 2: Inspect Surfaces Under Controlled Light

Condition defines value more than any other factor. Soft diffused light reveals texture without glare, helping detect wear patterns, marks, and natural patina. The goal is to understand how the coin aged and whether it passed through long circulation or careful storage.

Check:

- Highest relief points

- Friction on letters

- Scratches or contact marks

- Rim dents

- Corrosion or stains

- Colour tone and natural patina

These observations place the coin into a realistic grade bracket. A bright lamp exaggerates damage, while uneven light hides important details, so consistent lighting is essential for accurate judgment.

Step 3: Grade the Coin

Basic grading does not require expert certification; it requires understanding how details fade. Compare what remains on the coin with what the type should display. Focus on relief strength, inscription completeness, and the balance between worn and untouched areas.

Sheldon-Based Reference Table

| Visible Condition | Approximate Sheldon Range | Meaning |

| Full, sharp detail, no wear, strong fields | MS60–MS65+ | Uncirculated category; highest market tier |

| Minimal friction on the highest points, nearly full detail | AU50–AU58 | About Uncirculated; small wear, high collector demand |

| Light overall wear, major elements clear and complete | XF40–XF45 | Extremely Fine; strong mid-grade supply |

| Moderate wear, fine detail present, inscriptions clean | VF20–VF35 | Very Fine; balanced price range |

| Heavy wear, major design still visible | F12–F15 | Fine; common circulation grade |

| Design worn flat in most areas, outlines faint | G4–G6 | Good; lower category, low market value |

| Portions of the design are missing; the shape is identifiable only | AG3–Poor | Lowest grade; minimal collector value |

Recognising these distinctions helps narrow the value corridor before comparing actual market data.

Step 4: Compare With Standard References

Printed catalogues, long-term guides, and specialised books provide stable information unaffected by short-term price swings. They form the base for understanding the series as a whole.

They offer:

- Typical market values across grades

- Which dates become scarce in higher condition

- Documented varieties and their premiums

- Historical behaviour and long-term pricing trends

These references give context that digital sources sometimes lack. They explain why a common date may suddenly show strong value or why a low-mintage issue remains inexpensive.

Step 5: Analyse Recent Completed Sales

Real value appears in completed transactions, not in asking prices. Study final sale results across multiple platforms to see where buyers and sellers align.

Evaluate sales by checking:

- Same year and mint mark

- Similar grade level

- Comparable surface quality

- Consistency across several results

A pattern usually forms quickly: common coins cluster around a tight range, while scarce grades show jumps and gaps.

Step 6: Check for Cleaning and Damage

Cleaning reduces value because it alters texture and removes the original metal flow. Damage also lowers the category regardless of remaining design detail.

Look for:

- Parallel abrasive lines

- Chemical brightness

- Deep scratches

- Bends or structural issues

- Heavy corrosion

- Rim distortion

Any of these flaws can reduce value sharply. Even minor cleaning can shift a coin out of a premium category.

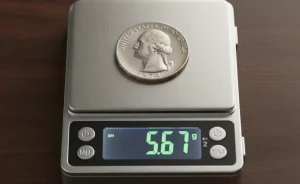

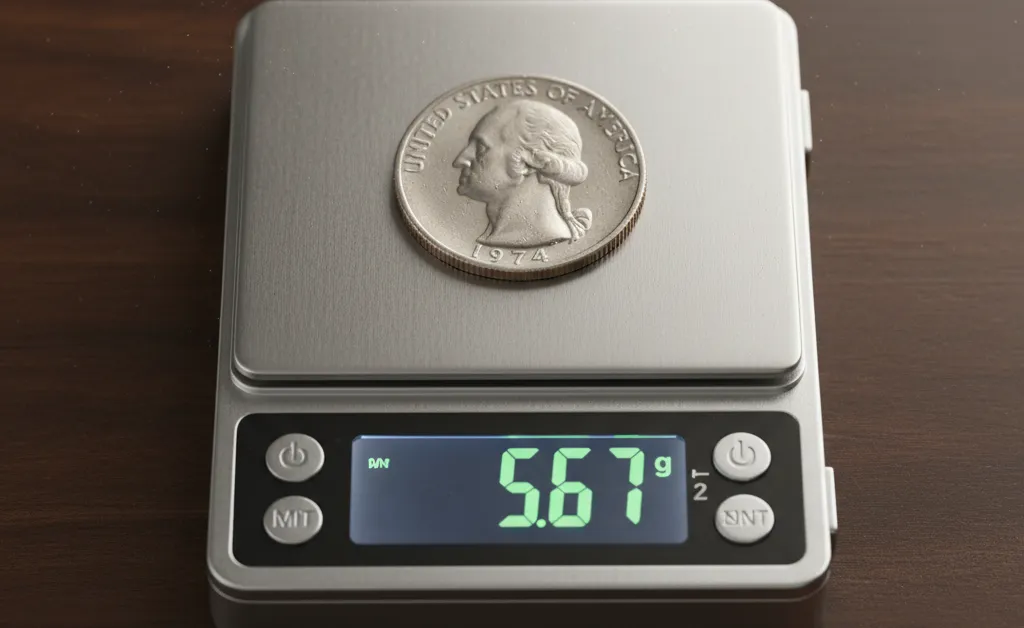

Step 7: Consider Metal Composition

Metal affects value in two ways: intrinsic worth and collector demand. Silver and gold coins may follow metal markets, while bronze or clad coins rely strictly on numismatic interest.

Points to verify:

| What to Check | Purpose |

| Weight & diameter | Confirms authenticity |

| Purity or alloy | Determines intrinsic worth |

| Metal tone | Identifies cleaning or corrosion |

| Expected behaviour | Shows whether the metal value or the collector value dominates |

Understanding this separation helps avoid overpricing common bullion-based coins or undervaluing key-date base-metal issues.

Step 8: Evaluate Survival Patterns

Survival rate explains why some common-mintage issues become valuable. Many coins disappear due to melting, environmental damage, or long circulation.

Clues of low survival:

- Very few high-grade examples for sale

- Consistent premiums in mid grades

- Older issues with notable melt history

A date with high mintage but low survival in clean condition often becomes far more valuable than beginners expect.

Step 9: Study Grade Distribution

Grade distribution shows how supply spreads across quality levels. It determines how much collectors must pay to obtain higher examples.

If most coins are worn, mid-grade pieces increase in value. If high-grade examples exist in abundance, the market stabilises despite strong demand.

Distribution explains why coins with identical mintage can behave differently in pricing.

Step 10: Eliminate Counterfeits

Even without expert tools, basic checks reveal many fakes. Compare weight, diameter, edge style, and metal tone with official specifications. Study the portrait and lettering for softness or distortion.

Modern counterfeits often show inconsistent texture, blurred details, or incorrect metal behaviour under light. Simple verification prevents overpaying for altered or imitation pieces.

Combining Both Methods into One Reliable System

A balanced valuation becomes stronger when digital tools and manual inspection work together. Apps give structure, confirm type, and provide the official framework. Manual checks reveal the real condition, detect damage, and show how the coin behaves on the market. When both parts are aligned, the collector receives a result that is stable and grounded, not based on guesswork.

A reliable system follows one clear sequence:

- Identify the type with an app; this confirms denomination, country, metal, and prevents mistakes with similar designs

- Confirm details manually; check the mint mark, year style, portrait version, and small variations that influence rarity

- Judge condition; evaluate wear, field quality, colour tone, and surface behaviour under light

- Compare with reference guides; match the coin’s grade to standard examples and long-term price tables

- Check real sales; study completed listings, not asking prices, to understand actual demand

- Adjust the value based on survival and grade rarity; consider how many pieces exist in similar condition

- Verify authenticity; confirm weight, diameter, edge style, and fine details before final judgement

This sequence keeps the process clear and prevents errors. Using both methods gives a price based on real condition, confirmed type, and actual market data.

Conclusion: Independent Valuation Made Clear

Appraisal is not required to judge value accurately. Digital tools help classify the coin and provide a solid starting point. Manual evaluation reveals grade, rarity, survival behaviour, and authenticity.

Using both ways gives a complete picture. Tools such as Coin ID Scanner make the first stage easy, while careful inspection and market comparison complete the final price estimate. With this method, any collector can evaluate coins safely, confidently, and accurately — without expert intervention.